Elevating Investment Transparency in Startups

Our client identified a gap in the Australian early-stage investment market: everyday investors struggle to track unlisted portfolio values and hold startups accountable, leading to a lack of transparency and control.

With the unique dynamics of the Australian startup ecosystem and complex legal requirements within the investment sector, many existing platforms become jarring and overly complicated, resulting in low usage and adoption.

The ask from our client was to create a platform that simplifies these challenges while catering specifically to the Australian early-stage investment landscape. The demand was clear—over 200 users signed up before the MVP release, driven solely by the client's industry outreach, highlighting a strong market need.

Client

Trove

Services

Product Design

Year

2024

Role

Product Designer

Roles and Responsibilities

Led user research to better understand problem space and whether it exists

Served as the sole product designer for the entire web-app experience

Built the branding guidelines from scratch

Collaborated closely with software engineers to ensure seamless implementation

Managed stakeholder communications to ensure the product met client expectations

Oversaw QA processes to ensure that the design was properly implemented and addressed any design-related issues

Assisted with product management, including defining the vision, success metrics, roadmap planning, and prioritisation

Prepared design documentation for product build

Assisted the founder in creating the financial calculations essential for the product

The Problem

There’s a lack of effective tracking and communication for Australian early-stage investors.

An experienced investor in the Australian startup ecosystem, who was previously a startup founder, approached us with insights into two major challenges he discovered through personal experience and recognised as common issues in the industry:

Investors struggle to accurately track the value of their unlisted investments, leading to uncertainty and difficulty in assessing portfolio performance.

Existing platforms fail to facilitate clear and effective communication between investors and early-stage startups, resulting in misunderstandings and a lack of accountability.

These issues stem from the fact that current solutions are not tailored to the unique needs of the Australian startup ecosystem. Global platforms often do not address local regulatory requirements or integrate with Australian financial systems, causing inefficiencies and reduced usability. Addressing these challenges will enhance tracking capabilities and improve communication, supporting more informed investment decisions and contributing to the growth of the Australian startup ecosystem.

Why This Problem Matters Now

Addressing the problem will unlock significant commercial potential in the Australian early-stage startup market.

Addressing the issues of investment tracking and communication presents a significant commercial opportunity:

Market Opportunity

With over 2,000 early-stage startups in Australia, capturing just 10% of this market could facilitate investments worth approximately AUD 200 million. This estimate is based on an average investment size per startup, demonstrating substantial market potential.

Current Gaps

Existing global platforms (i.e. Carta, Seedblink, and Visible.vc) fail to meet the unique needs of the Australian market, leaving a valuable gap.

Economic Impact

Solving these challenges can drive significant economic growth, enhance the startup ecosystem, and attract more investment into Australian startups.

Thorough research, including feedback from Australian early-stage investors and industry analysis, highlights the urgency and potential impact of solving these issues. This presents a substantial opportunity to make a significant impact on the Australian investment landscape.

Define Success

Success meant users found value and remained engaged.

When it came to defining our team's success for the MVP, we were held accountable for the following:

New User Acquisition

Attracting at least 200 new users within the first three months, including private investors and Australian startups.

Ensuring 80% of users complete the data collection, which involves filling out investment details essential for fully realising the platform's value.

Active User Engagement

Achieving at least 50% of users actively engaging with the platform.

Discovering the Challenges - 1

Understanding the current investor journey

Investors in early-stage startups face a complex process, from crafting agreements to navigating local preferences and startup-specific challenges. Understanding their journey helps clarify the pain points that hinder smooth investments.

Before making any financial commitment, investors typically negotiate agreements with startups. These customised agreements outline key performance milestones such as customer growth targets or revenue projections. These benchmarks help investors assess whether the startup is on track before they inject capital.

Australian early-stage investors favour local startups for legal benefits such as tax incentives, including Early Stage Innovation Company (ESIC) tax offsets and capital gains exemptions, and a better grasp of the local market dynamics.

Investing in startups is starkly different from investing in publicly traded stocks. In the stock market, valuations are determined by market forces, which reflect real-time performance. But for startups, valuations (known as post-money valuations) are often speculative, dictated by the founders themselves, and only adjust during capital raises. This lack of market-driven transparency makes it harder for investors to track the true value of their investments.

From on these insights, we discovered the key pain point:

Key Pain Point:

Disconnect Between Startups and Investors

Effective communication is vital because startup valuations do not reflect real-time company performance or market conditions. Startups often fail to provide promised updates, and investors may struggle to reach the right contacts for timely responses. This disconnect leads to frustration and challenges in managing investments.

Discovering the Challenges - 2

Validating startup experiences

To create a truly impactful platform for investors, we must also address the realities faced by startups. After all, if our solution resonates with investors but fails to meet the needs of startups, we risk low engagement and adoption.

Startups often find themselves caught in a cycle of missed expectations and unfulfilled promises. When they struggle to provide regular updates, investors are left in the dark, creating a sense of disconnect that undermines trust. Our solution should facilitate smooth interactions to keep both parties informed.

Startups operate under the pressure of meeting specific milestones set by investors. This dynamic can lead to stress and misalignment. Our solution should help clarify expectations and support startups in achieving their goals while keeping investors in the loop.

Constructive feedback from investors is vital for startups looking to refine their strategies. When communication falters, they miss essential insights that could guide growth and strengthen relationships. Our solution must encourage open dialogue to foster productive partnerships.

By validating these shared experiences, we recognise the importance of building a platform that fosters meaningful connections. If our product can enhance communication and accountability, it will empower both investors and startups, ensuring mutual value and engagement in the Australian early-stage investment ecosystem.

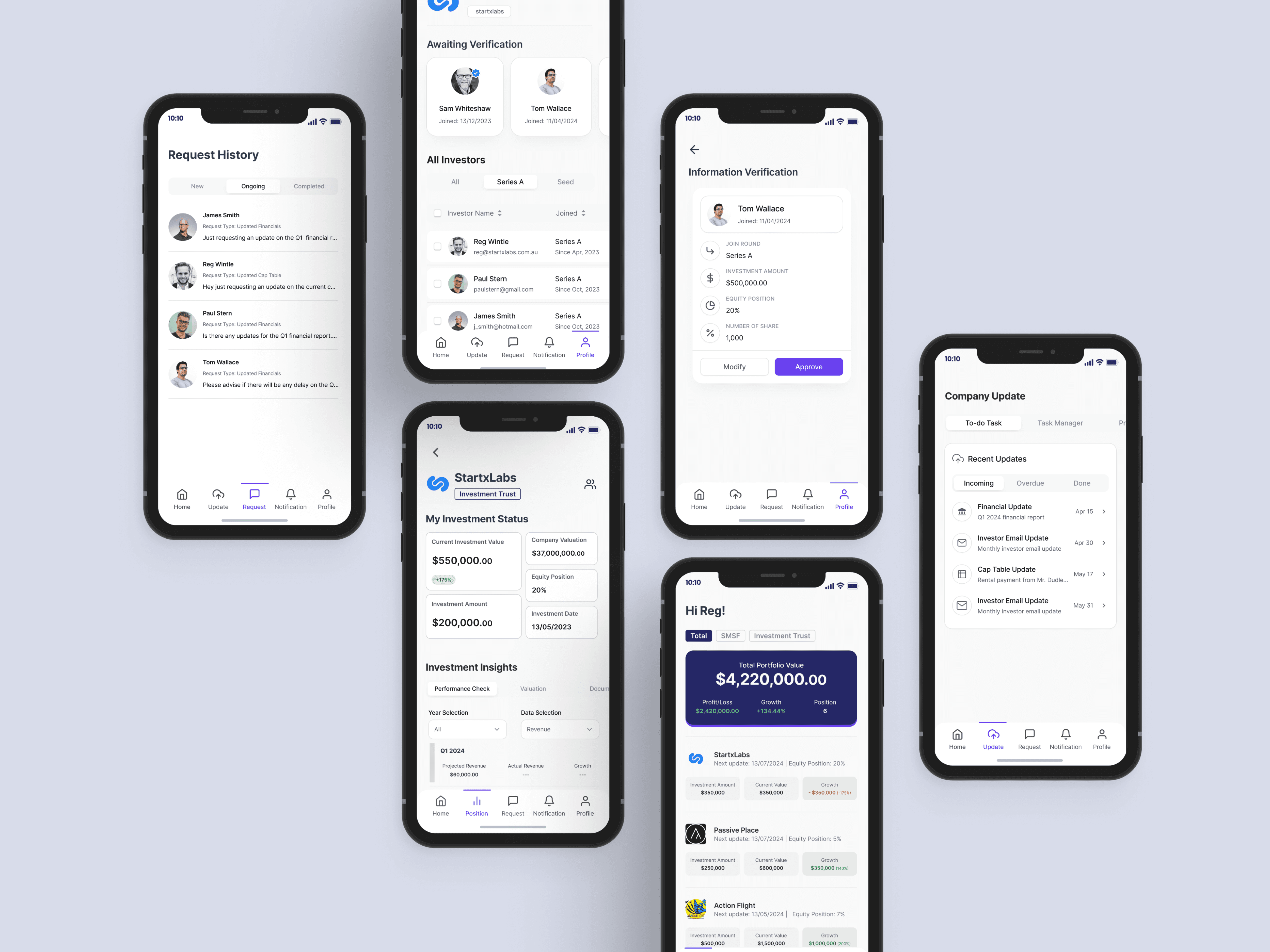

What We Needed to Deliver

Improve transparency and accountability in investment tracking.

Investors needed clear access to essential updates and information from startups, enabling them to hold companies accountable and make informed decisions. Without effective visibility, investors risked feeling disconnected from their investments, leading to frustration and uncertainty.

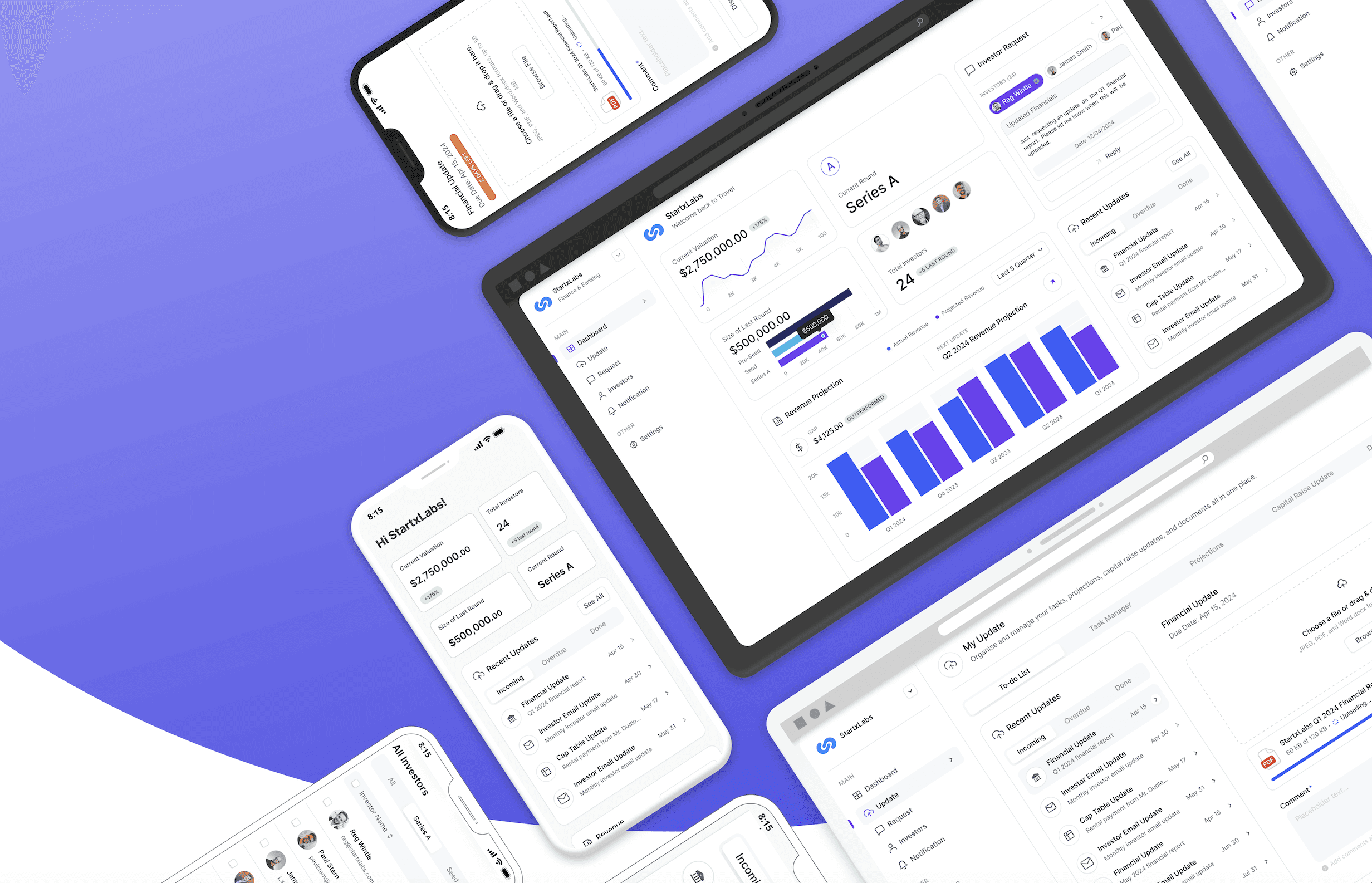

What We Shipped - 1

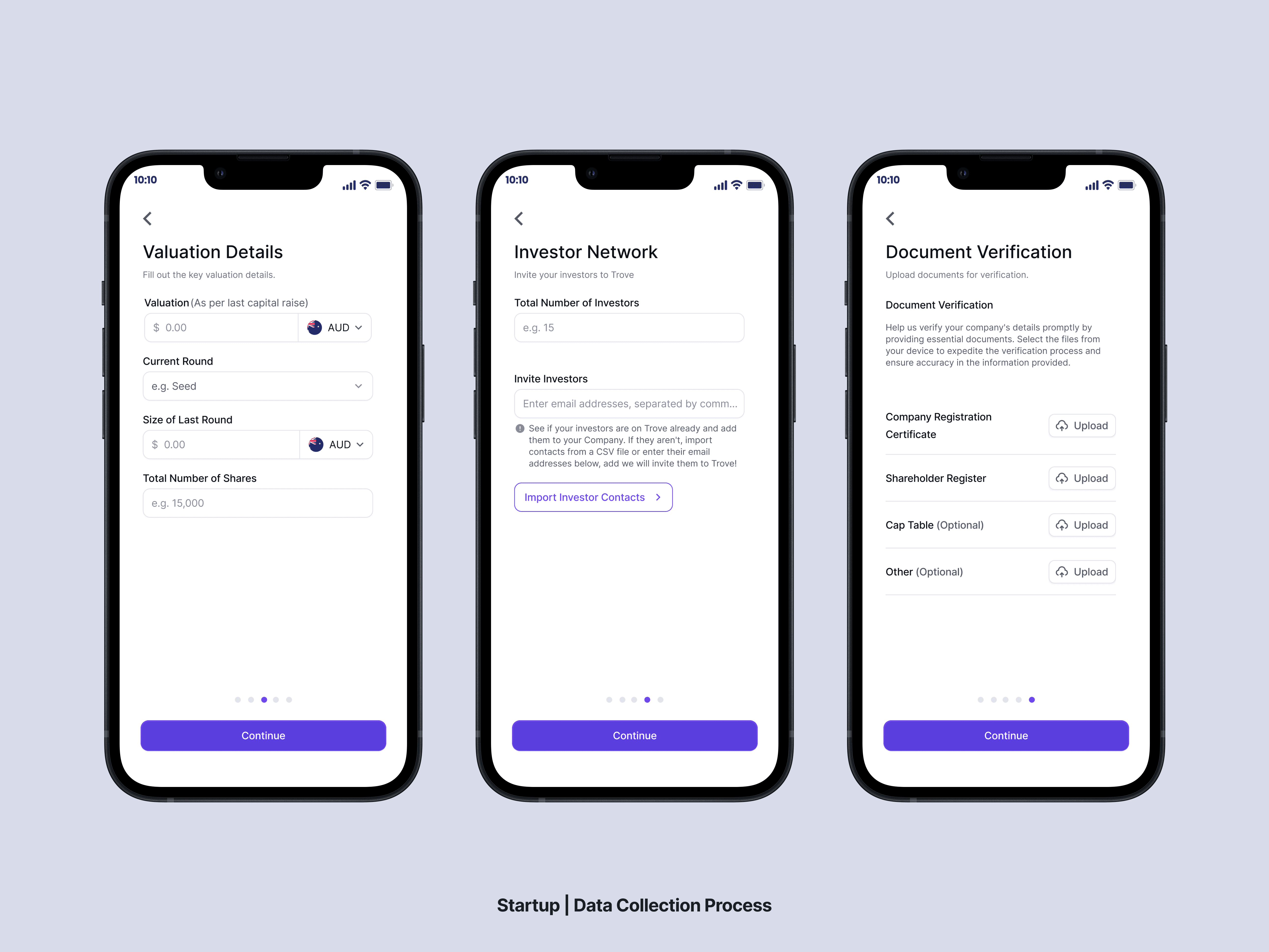

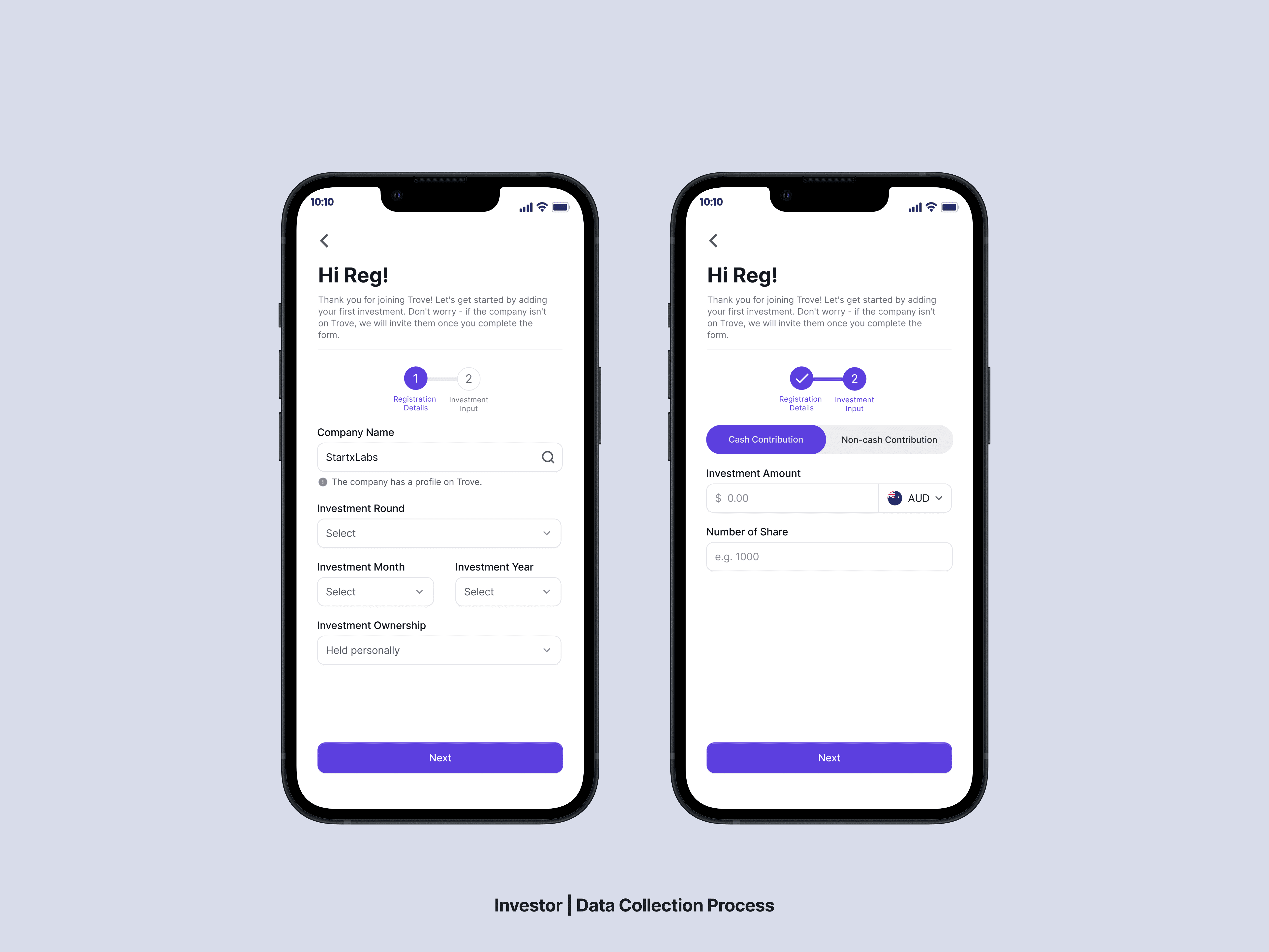

Simplifying financial data collection to ensure accurate valuations and prevent adoption barriers.

Achieving an 80% completion rate for data collection was essential for Trove. This process involved startups and investors inputting detailed financial information, and its importance lay in ensuring users receive the full platform experience. Low completion rates risked inadequate data, which could undermine the platform's value and hinder user adoption.

Key barriers to completion included time constraints and user reluctance to provide extensive financial details. To address this, I focused on streamlining the data collection process. By prioritising the collection of critical information—like total shares and investment amounts—over percentages, I minimised errors related to share dilution and ensured clearer equity calculations. I also simplified the process into a maximum of three concise steps, each taking less than five minutes, to reduce friction and enhance user experience.

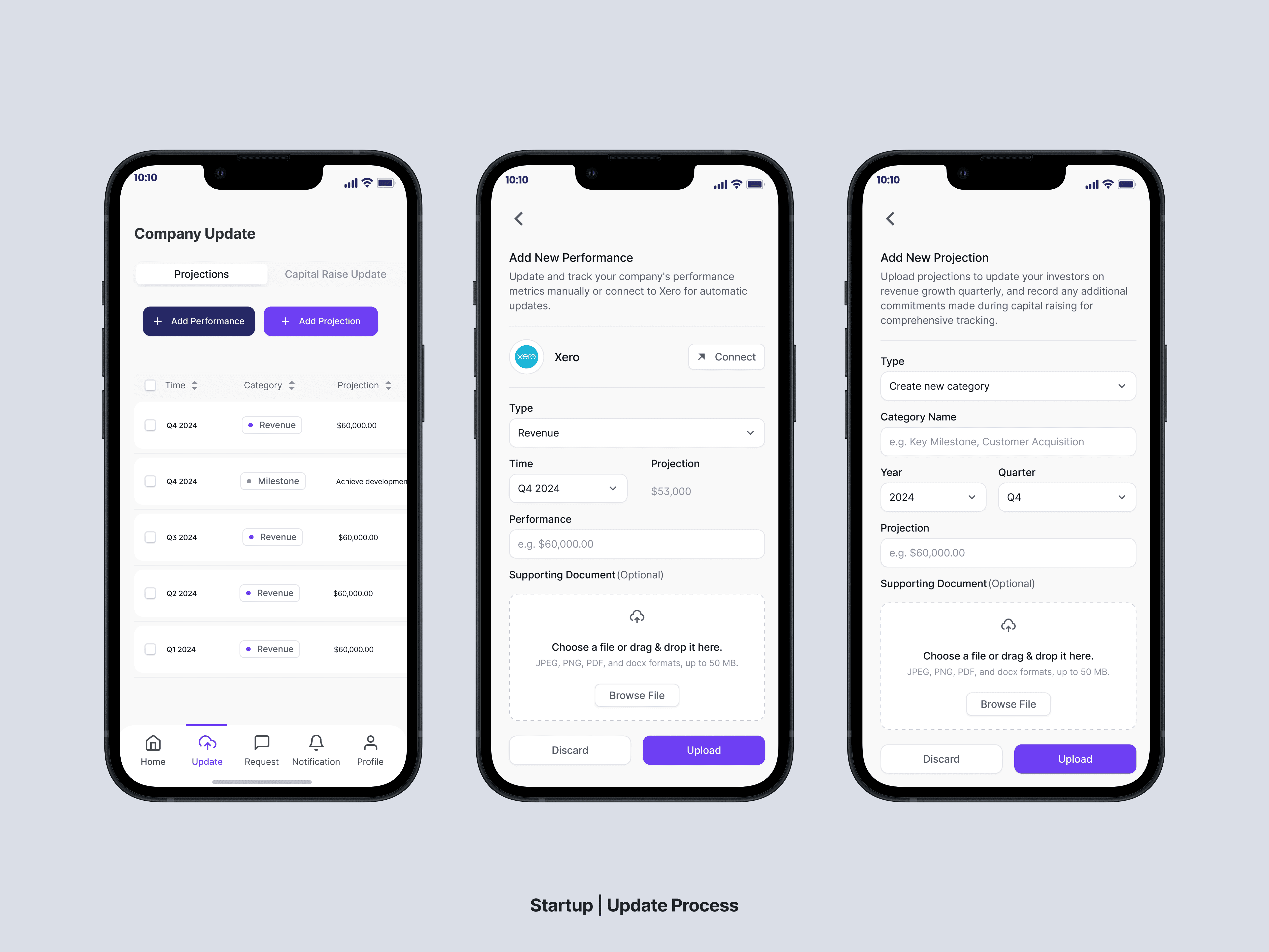

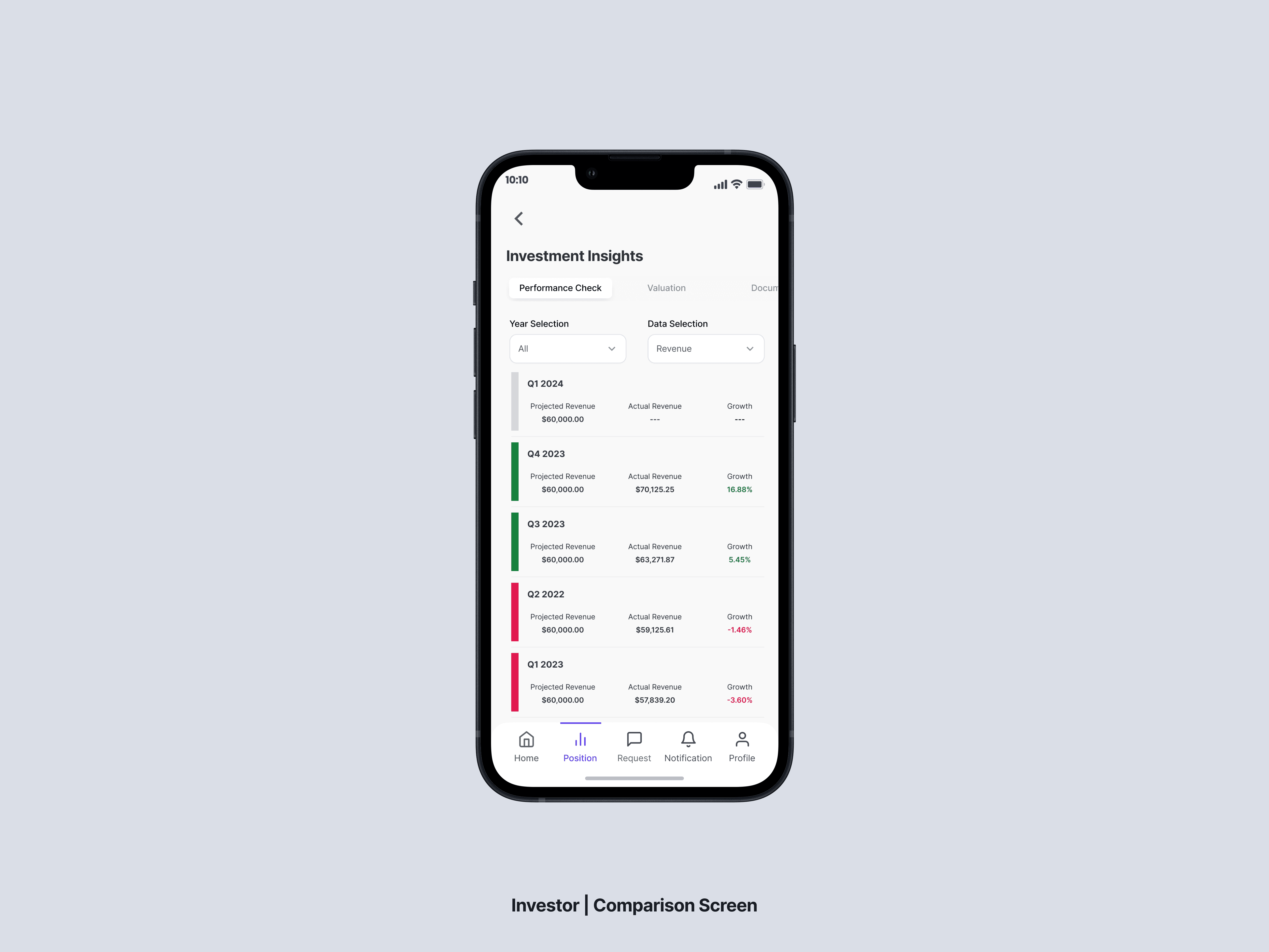

What We Shipped - 2

Minimising effort for startups, maximising insights for investors.

Investors rely on comparing a startup’s financial projections with actual performance to make informed decisions. However, startups often find updating this data time-consuming, leading to low usage rates. This lack of updates can cause investors to lose confidence in the platform, impacting its overall adoption.

To tackle this, we designed a process tailored to Australian startup practices by integrating Xero, widely used across the local startup ecosystem, for seamless automatic updates. For those not using Xero, we provided a simple manual update form. This approach minimised the effort required from startups, ensuring investors received the essential data they needed, and reducing the risk of incomplete information hindering platform engagement.

Let's Talk About Impact

Our product achieved great success with strong market validation.

These outcomes highlight the platform’s strong market validation and its promising future, with early user engagement and investor interest confirming its relevance and growth potential.

Successfully moved into the development phase, a critical milestone demonstrating the project's feasibility and alignment with market needs.

Secured over 200 sign-ups, including private investors and Australian startups, prior to the MVP release.

Investor Interest

Currently in fundraising, with interest from 3+ investors, underscoring the product’s potential and appeal.

Next Steps

This is just the beginning: Here’s what’s next!

Complete the ongoing development and conduct thorough testing to ensure the platform’s functionality and user experience meet high standards.

Prepare for the official launch by finalising marketing plans, onboarding processes, and support systems.

Implement a support plan to address user feedback, resolve any issues, and continue improving the platform based on real-world use.

Leverage investor support and market insights to scale the product, expand user acquisition efforts, and drive adoption in the Australian investment ecosystem

Takeaways

Our client’s experience as both a startup founder and investor offered critical insights into the needs of our target users. Their deep understanding of the problem and industry connections helped validate the issue and guide our design decisions. It demonstrated how leveraging client expertise can significantly enhance the design process when you're not an expert in the field.

The client had a broad vision for the platform, but I did well in guiding them to focus on the essential features of the MVP. By narrowing the scope to these core needs, I ensured alignment with our goal of getting the MVP to the market as soon as possible. This experience highlighted the importance of balancing client ambitions with practical constraints, reinforcing my skills in product thinking, managing expectations, and prioritising critical features.